Strong Market Show After 7 Weak Sessions, Nifty Up By 1%

Feb 09, 2018 | 12:36 PM IST

Feb 09, 2018 | 12:36 PM IST

Share Market News 08-February-2018

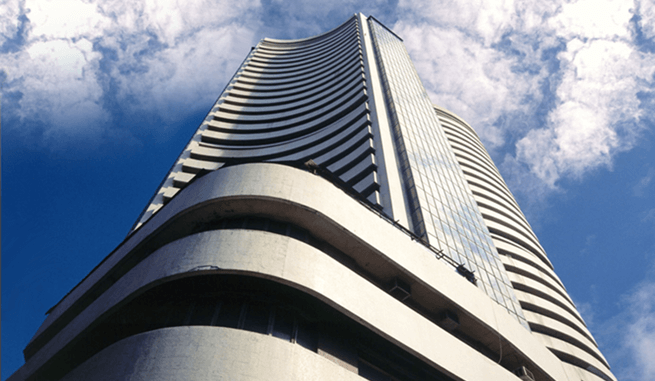

The market rebounded with mild gains on Thursday as Sensex climbed over 100 points above 34,500 level while Nifty jumped over 25 points above 10,500. Bulls took complete control at D-Street as Sensex gained over 400 points near 34,500 level while Nifty gained over 115 points as it traded near 10,600. Broader market outperformed Equity benchmark indices as Nifty midcap was up by 1.5% led by HDFC twin, RIL, Infosys, TCS.

In the afternoon session, benchmark indices extended upward momentum as Sensex rallied over 450 points while Nifty soared over 130 points to trade above 10,600 levels. The market gained more strength in the afternoon as the Sensex rallied more than 500 points and Nifty is trading above 10,600 levels. Nifty Midcap also extended gains to 2 percent.

In last hour of trade, the market was off days high as Sensex raised more than 300 points while Nifty traded below 10,600 levels due to some profit booking at higher levels. Benchmark Indices closed sharply higher, though they were off days high but broader market outperformed as Nifty midcap was up by 1.78%. Sensex closed 330.45 points up at 34,413.16, Nifty up by 100.15 points at 10,576.85.

Top Gainers

Cipla by 8.21% to Rs.616, Ambuja Cement by 7.13% to Rs.266, Sun Pharma by 6.44% to Rs.584.90, Bharti Infratel by 3.47% to Rs.350.30, Indiabulls Housing Finance by 3.39% to Rs.1,317.25.

Top Losers

AuroPharma by -2.45% to Rs.601, NTPC by -1.03% to Rs.163.75, ONGC by -0.66 to Rs.188.75, Adani Ports by -0.49% to Rs.405, ITC by -0.45% to Rs.273.90.

Analysis Of Top Gainer And Loser

Cipla is the top gainer in today's market as the company reported a 7% rise in its December quarter net profit to Rs.401 crore from Rs.375 crore a year earlier. Revenue from India rose 15% to Rs.1,601 crore. Domestic revenue accounted for more than a third of the total revenue, which rose 7% to Rs.3,914 crore.

AuroPharma is the top loser in today's market as the company reported a Rs.595 crore consolidated net profit for the quarter ended December 2017, which was 2.83% higher compared to the 578.59 crore it had posted in the corresponding quarter of the previous fiscal.

Key Market News

The US Senate today reached a rare bipartisan compromise to avert another crippling government shutdown by reaching a two-year budget deal to raise spending on military and domestic programmes by almost USD 300 billion.

The Association of National Exchanges Members of India (ANMI) will seek set off of Securities Transaction Tax (STT) against long-term capital gains tax (LTCG) from the Finance Ministry. According to ANMI, the implementation of both STT and LTCG may lead to job losses with no major benefit to government revenues.

China's January Trade data today showed exports rose 11.1 percent to USD 200.5 billion, up from December's 10.9 percent growth. Imports surged 36.9 percent to USD 180.1 billion, up from the previous month's 4.5 percent. Import growth was driven in part by demand from factories that are restocking before shutting down for the Lunar New Year holiday. The holiday falls at different times each year in January or February, distorting trade data.

Stocks To Watch

Bharat Forge Ltd. is on the upside while Hexaware Technologies Ltd. on the downside.

Bharat Forge is currently trading at Rs.762.25, up by Rs.55.95 or 7.92% from its previous closing of Rs.706.30 on the NSE. The scrip opened at Rs.706.90 and has touched a high and low of Rs.764.80 and Rs.706.90 respectively. So far 37,09,081 (NSE) shares were traded on the counter. The current market cap of the company is Rs.35,410.66 Crore. The NSE/BSE group stock has touched a 52 week high of Rs.764.80 on 08-February-2018 and a 52 week low of Rs.480 on 08-February-2017.

Hexaware Techno is currently trading at Rs.337.75, down by Rs.17.80 or 5.01% from its previous closing of Rs.355.55 on the NSE. The scrip opened at Rs.351.80 and has touched a high and low of Rs.354 and Rs.333.60 respectively. So far 31,98,445 (NSE) shares were traded on the counter. The current market cap of the company is Rs.10,015.64 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.394.50 on 24-January-2018 and a 52 week low of Rs.195.25 on 07-February-2017.