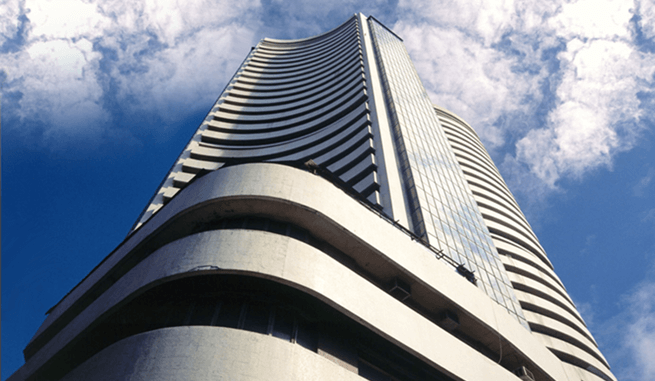

Pharma Rallied In The Flat Market; Nifty At 9650

Jul 07, 2017 | 18:11 PM IST

Jul 07, 2017 | 18:11 PM IST

Share Market News 07 July 2017

Todays market opened negative on profit booking as some of the stocks were trading at the resistance level. However, there was a huge buying seen in some other sector stocks due to which the market traded in a narrow range. Pharma sector rallied in today's market. Sensex lost 8.71 points to 31360.63; Nifty lost 8.75 points to 9665.80.

Top Gainers

Lupin By 3.63% to 1120.60 Reliance.By 3.30% to 1490.20, Aurobindo Pharma by 2.24% to 698.70, Dr.Reddy 1.59% to 2710.45 And ZEEL. By 1.44% to 508.25.

Top Losers

Infratel by 2.28% to 405.25, Ambuja Cement by 1.73% to 252.15, Indiabulls Housing Finance by 1.69% to 1064.90, Vedanta Ltd by 1.61% to 257.45 And Bosh Ltd by 1.41% to 23450.

Analysis of Top Gainer and Loser

Lupin is the top gainer in today's market as the company launched Generic Vigamox Ophthalmic medicine in the US which is used for bacterial conjunctivitis treatment. After receiving approval from USFDA (US Food and Drug Administration)

Infratel is the top loser in today's market due to normal profit booking that was seen in the stock as it rallied almost 8% this week and price is at the resistance level.

Key Market News

To standardise FDI investment and increasing FDI in India, Department of Industrial Policy and Promotion (DIPP) is going to take 13 ministries meeting on 13 July onwards. Most of the sectors are allowed in Foreign Direct Investment through automatic route but only defence and retail trading require government approval for FDI from DIPP. This meeting is going to discuss the issue regarding online application, security clearance procedure and standard operating procedure (SOP) for clearance and approvals of FDI applications regarding defence and retail trading.

The effect of demonetisation and linking of Pan card with Adhaar card is visible now as net direct tax collection has increased by 14.8% to Rs 1.42 lakh crore at the end of first quarter of 2017 on account of surge in advance tax payments. The increase in corporate advance tax is 8.1% and in personal advance tax is at 40.3%.

Stocks to Watch

Reliance Industries is on the upside while Bajaj Auto is on the downside.

Reliance Industries is currently trading at Rs.1491.15, up by Rs.48.60 or 3.37% from its previous closing of Rs.1442.55 on the NSE. The scrip opened at Rs.1443 and has touched a high and low of Rs. 1497.75 and Rs.1440. respectively. So far 8193635(NSE) shares were traded on the counter. The current market cap of the company is Rs.484724 Crore. The BSE/NSE group stock has touched a 52 week high of Rs. 1497.75 on 07-July-2017 and a 52 week low of Rs.930 on 09-November-2016

Bajaj Auto is currently trading at Rs.2708.25, down by Rs.20.35 or 0.75% from its previous closing of Rs.2728.60 on the NSE. The scrip opened at Rs 2716 and has touched a high and low of Rs.2733 and Rs.2694.50 respectively. So far 289993(NSE) shares were traded on the counter. The current market cap of the company is Rs.78359 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.3120 On 08-September-2016 and a 52 week low of Rs 2510 on 21-November-2016.