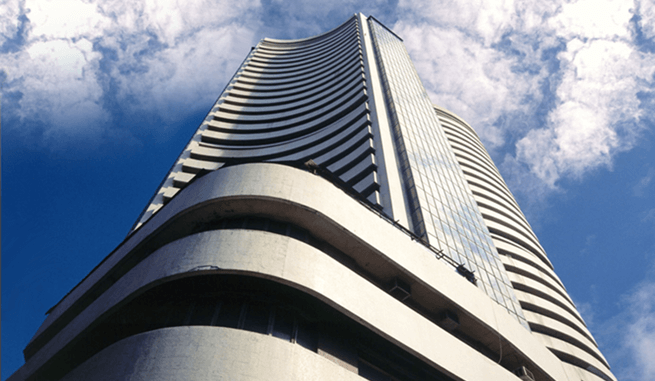

Market Snapped 6-Day Losing Streak; Nifty Near 10,250

Mar 08, 2018 | 18:57 PM IST

Mar 08, 2018 | 18:57 PM IST

Share Market News 08-March-2018

The Benchmark indices opened sharply higher as Sensex was up by 230 points & Nifty started above 10,200, tracked positive Asian cues. The equity market turned volatile after whipped opening gains as Sensex was just up by 90 points while Nifty fell below 10,200 levels despite positive trade in Asia. Nifty Midcap index continued to underperformed market, fell over a percent. All sectoral indices were in the red barring IT.

In the afternoon session, the market extended gains with sensex rose over 230 points & Nifty traded back above 10,200. The Nifty Midcap underperformed indices, traded flat after showed a recovery from day's low. Banks and auto stocks gained strength while metals and pharma stocks traded in the red.

In the last hour of trade, equity benchmark rallied further as Sensex surged over 400 points & Nifty traded above 10,250 levels as short covering continued in banking & financials stocks. The market closed higher after 6-day losing streak, backed by short covering in banking & financial stocks. Nifty midcap & smallcap also closed higher. PSU bank index gained most, was up almost 3%. Sensex closed 318.48 points down at 33,351.57, Nifty down by 88.45 points at 10,242.65.

Top Gainers

SBIN by 4.05% to Rs.256.65, ICICI Bank by 3.91% to Rs.297.90, Adani Ports by 3.44% to Rs.389.90, Reliance by 2.39% to Rs.911, M&M by 2.29% to Rs.724.

Top Losers

Sun Pharma by -2.83% to Rs.510, Tata Steel by -1.77% to Rs.636.35, Hindalco by -1.11 to Rs.221.95, Yes Bank by -0.99% to Rs.308.85, Tech Mahindra by -0.88% to Rs.603.70.

Analysis Of Top Gainer And Loser

SBIN is the top gainer in today's market as strong short covering was seen in the stock.

Sun Pharma is the top loser in today's market as troubles with the US drug regulator will continue, as details of the recent observations revealed that the resolution of issues at its Halol manufacturing plant might take longer than expected.

Key Market News

India has made a pitch to ratings agency Fitch for a sovereign upgrade, pointing to structural reforms and sound macroeconomic indicators. The New York City headquartered agency had last upgraded Indias sovereign rating from BB+ to BBB- with stable outlook on August 1, 2006.

The government sought Parliament nod for additional cash spending of Rs.85,315.30 crore in the current fiscal, of which 70 percent is earmarked to compensate states for revenue loss on account of GST roll out. Approval of Parliament is sought to authorise gross additional expenditure of over Rs.9.06 lakh crore, part of which would be matched by savings by various ministries, the document said.

Indias bond market is pricing in a rise of about 75 basis points in the headline rates, pointing to reduced investor appetite for sovereign debt amid concerns over fiscal discipline and an across-the-board global increase in the cost of funds.

Stocks To Watch

Bhushan Steel Ltd. is on the upside while IDBI Bank Ltd. is on the downside.

Bhushan Steel is currently trading at Rs.47.70, up by Rs.7.15 or 17.63% from its previous closing of Rs.40.55 on the NSE. The scrip opened at Rs.47 and has touched a high and low of Rs.48.65 and Rs.44.25 respectively. So far 1,76,94,932 (NSE) shares were traded on the counter. The current market cap of the company is Rs.1,069.13 Crore. The NSE/BSE group stock has touched a 52 week high of Rs.102.70 on 18-May-2017 and a 52 week low of Rs.39.15 on 06-February-2018.

IDBI Bank is currently trading at Rs.74.35, down by Rs.4.80 or 6.06% from its previous closing of Rs.79.15 on the NSE. The scrip opened at Rs.80.95 and has touched a high and low of Rs.82.70 and Rs.73.10 respectively. So far 6,16,01,682 (NSE) shares were traded on the counter. The current market cap of the company is Rs.19,779.05 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.91.50 on 05-March-2018 and a 52 week low of Rs.50.20 on 14-August-2017.