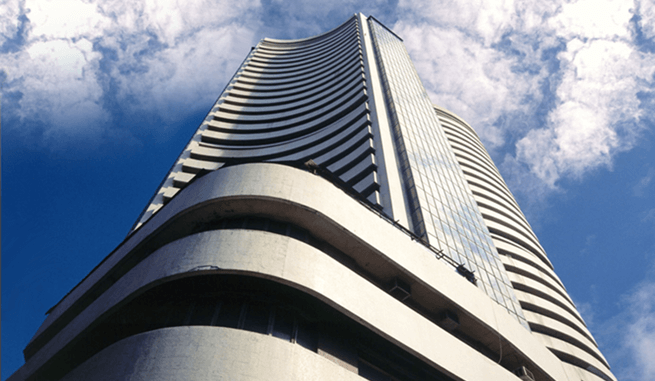

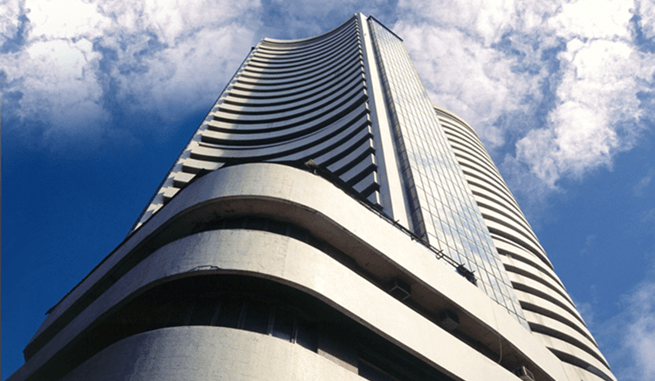

Sensex Ends 5-Day Losing Streak; Nifty Above 10,100

Mar 20, 2018 | 18:12 PM IST

Mar 20, 2018 | 18:12 PM IST

Share Market News 20-March-2018

The Benchmark indices extended previous days losses as Sensex was down by 100 points & Nifty fell 32 points, amid weak Global cues. The equity market extended gains and recouped all opening losses, as Sensex rose 150 points while Nifty reclaimed 10,150 ahead of US Feds key policy meet starting today. The Midcap also gained half a percent while Nifty IT outperformed market in sectoral indices, was up nearly 1%.

In the afternoon session, the market remained volatile with Sensex hovering around 33,000 levels while Nifty traded above 10,100 as investors looked for cues from two-day US Federal Reserve meeting beginning later in the day. Nifty midcap also traded flat. Technology, Tata Group and select banking & financial stocks supported the market.

In last hour of trade equity benchmark continued to trade higher as Sensex gained over 50 points while Nifty continues to trade above 10,100. The market closed mildly higher amid volatility ahead of US Fed meet. Nifty midcap also closed in green while Nifty IT outperformed, was up by 1.51% Sensex closed 73.64 points up at 32,996.76, Nifty up by 30.10 points at 10,124.35.

Top Gainers

Infratel by 4.96% to Rs.341.50, Tech Mahindra by 3.95% to Rs.634, Eicher Motors by 3.46% to Rs.28,350, Tata Steel by 3.37% to Rs.594.35, Sun Pharma by 2.46% to Rs.509.90.

Top Losers

VEDL by -6.12% to Rs.288.15, IOC by -2.30% to Rs.173.80, ONGC by -1.33 to Rs.174.50, BPCL by -1.10% to Rs.426.00, GAIL by -0.92% to Rs.438.00.

Analysis Of Top Gainer And Loser

Bharti Infratel is the top gainer in today's market as strong buying was seen in the stock.

VEDL is the top loser in today's market after the stock adjusted for interim dividend announced on March 13 of RS.21.20 per share. The record date for the purpose of payment of the first interim dividend to equity shareholders is fixed as March 21.

Key Market News

The US has recently requested dispute settlement consultations with India at the World Trade Organization to challenge Indias export subsidy programmes. A research note by Morgan Stanley says that the basis for the action is that India surpassed the defined economic benchmarks for developing countries with respect to export subsidies in 2015. US President Donald Trump has already threatened China and India with a reciprocal tax or US tariff at levels prevailing in those countries. The US runs a trade deficit of $23 billion with India, but this pales into insignificance compared with its deficit with China, which is $375 billion.

India has scrapped the 20% sugar export tax, a government source said, to help boost overseas sales in a surplus year of production. Last week Reuters reported that India, the world's biggest consumer of sugar, would axe the export tax on the sweetener and then make it compulsory for mills to export 2-3 million tonnes to cut bulging stocks at home.

Stocks To Watch

Reliance Infrastructure Ltd.is on the upside while Gujarat State Petronet Ltd. is on the downside.

Reliance Infra is currently trading at Rs.453.05, up by Rs.28.80 or 6.79% from its previous closing of Rs.424.25 on the NSE. The scrip opened at Rs.422 & has touched a high & low of Rs.456.80 and Rs.420.10 respectively. So far 57,44,461 (NSE) shares were traded on the counter. The current market cap of the company is Rs.11,922.65 Crore. The NSE/BSE group stock has touched a 52 week high of Rs.620.05 on 12-May-2017 & a 52 week low of Rs.390.55 on 15-November-2017.

GSPL is currently trading at Rs.176.90, down by Rs.11.20 or 5.95% from its previous closing of Rs.188.10 on the NSE. The scrip opened at Rs.186.45 & has touched a high and low of Rs.186.45 & Rs.173.65 respectively. So far 28,21,387 (NSE) shares were traded on the counter. The current market cap of the company is Rs.10,005.23 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.235.80 on 22-December-2017 and a 52 week low of Rs.154.75 on 10-July-2017.