GST Rate Announcement Stabilizes The Market

May 19, 2017 | 18:59 PM IST

May 19, 2017 | 18:59 PM IST

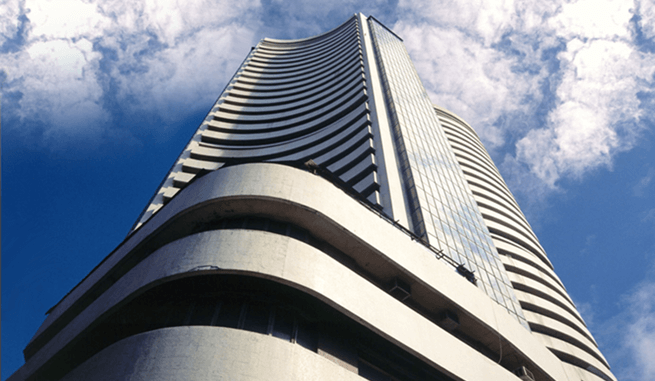

Todays market opened negative but saw a great tussle between bulls and bears as Sensex dropped almost 200 and only to gained 150 points, however, it ended flat due to mixed signal in the market. Sensex gained 30.13 points to 30464.92; Nifty lost 1.55 points to 9427.90.

Top Gainers

ITC by 3.06% to 286.40, Yes Bank by 2.08% to 1430.35, Axis Bank by 2.01% to 501.90, SBIN by 1.98% to 308.95 And Hindustan Unilever by 1.40% to 1004.10.

Top Losers

Asian Paint by 1.77% to 1131, BPCL by 1.59% to 703.50, Eicher Motors by 1.56% to 27915, Hindalco by 1.29% to 191.50 And TCS by 1.28% to 2503.85.

Key Market News

GST Council decided GST in relation to the service sector today in four slabs i.e. 5, 12, 18 and 28% compared to the current uniform 15% levy on all eligible services. However, in the services sector depending on the nature of the services various categories have been made. Some important are here as follow.

1) Transport services including air services and goods transport will be taxed at 5% from the existing 15%.

2) Restaurants with an annual turnover of less than Rs 50 lakh will fall under the 5% tax slab, while non-ACs food joints will be taxed at 12%. Air-conditioned restaurants with liquor licences will be taxed at 18%.

3) Hotels and lodges in which tariff below Rs 1000 a day will be exempted from GST, while those with a tariff of between Rs 1000-Rs 2,500 will be taxed at 12%. Five star and luxury hotels will be taxed at 28%.

4) Services related to gambling, race club betting and cinema halls will also be taxed at 28%.

Healthcare and education will be exempted from GST framework.

SBIN presented an outstanding numbers today as its standalone 4th quarter net profit increased to Rs 2,814.82 Crore from 1263.81 Crore in the same period a year ago. And NPA declined to 3.71% as against 3.81% a year ago.

Stocks to Watch

GMDC is on the upside while Cummins India is on the downside.

GMDC is currently trading at Rs.136.05, up by Rs.9.45 or 7.46% from its previous closing of Rs 126.60 on the NSE. The scrip opened at Rs.133.50 and has touched a high and low of Rs 140 and Rs 132.15.respectively. So far 5028715(NSE) shares were traded on the counter. The current market cap of the Company is Rs.4340 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.145 on 10-May-2017 and a 52 week low of Rs.64.80 on 18-May-2016.

Cummins India is currently trading at Rs.972.95, down by Rs.81.50 or 7.33% from its previous closing of Rs.1054.45 on the NSE The scrip opened at Rs.1015 and has touched a high and low of Rs.1019.90 and Rs.933 respectively. So far 2807183(NSE) shares were traded on the counter. The current market cap of the company is Rs.26827 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.1096.20 on 03-May-2017 and a 52 week low of Rs.746.80 on 26-May-2016.