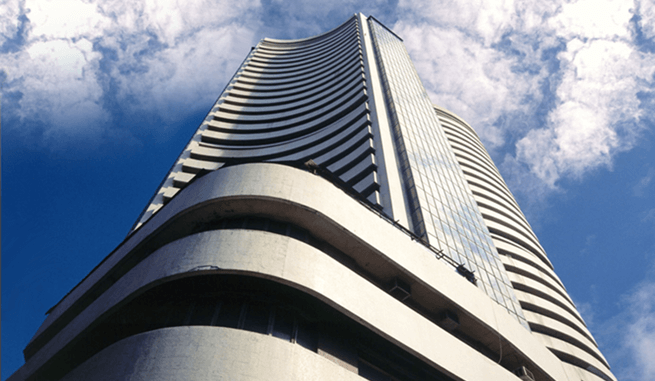

Can Optimism prevail global gloom?

Oct 29, 2014 | 10:29 AM IST

Oct 29, 2014 | 10:29 AM IST

Closing Review: 28th Oct 2014

Stock specific news and Q2 results have been directing major indices and thereby the stock

markets from past few trading sessions. As a result in todays session the tug-of-war between

Lupins weaker than expected results and Ranbaxys better than expected Q2 results moved the

markets to and fro.

Lot of movement seen in Bank Nifty which is in fact leading the benchmark.

Yesterdays fall must have been a breather which is why today markets opened and closed with

marginal gains. After a gap of one day markets surged again as if to make another positive rally.

Nifty closed at 8027 i.e. up 36 points while SENSEX closed at 26880 i.e. up 128 points from the

previous close.

Other Asian markets remained mixed amid volatile oil prices and concerns over Fed Res

interest rate announcement.

Rupee opened weaker and remained intraday flat at 61.3/USD. AD line turned positive with

1510 Advances and 1366 Declines.

Smallcap and Midcap indices outperformed and ended with 0.5% plus gains i.e. slight higher

than the benchmark. Pharma soared 1.3% after Ranbaxy posted its positive results. PSU Bank

led the move throughout and closed with 1.5% gains. Metal and FMCG closed flat to negative.

All other sectors closed in green.

Sun Pharmaceuticals, Cipla and Tata Power are the top gainers while Lupin, Bharti Airtel and

Hero Motocorp were the top losers for the Nifty.

Option Data

Highest OI was witnessed at 8200CE & 8100CE and 8000PE and 7950PE. As per options data

8400CE and 8000 PE are likely to remain in focus for October series.

Highest OI was witnessed at 8200CE & 8300CE and 7700PE and 7800PE. As per options data

8300CE and 7800 PE are likely to remain in focus for November series.

Global Markets

US markets ended flat on Monday giving a break to S&P 500s biggest rally of the week. Energy

sector tumbled amid fall in the oil prices. Otherwise stock specific positive Q3 earnings spread

some optimism and held back major indices from falling.

Asian shares were a mixed bag on Tuesday amid pressure from falling oil prices and ahead of

hopes from Fed Res policy announcement. Hang Seng posted 1.63% gains on Monday amid

strong economic data from China.

European markets traded higher on Tuesday recovering previous days losses.

Market Overview for 29th Oct 2014

As stated Nifty gained momentum after a days break. Nifty sustained above 8000 mark

but could not breakthrough 8030 on closing basis. Moreover 8065 will also act as a major

resistance and till then nifty is likely to move in consolidation. On the downside 7980-7950 will

act as the support levels below which Nifty would break its consolidation on the downside.

We are heading towards October F&O expiry. Moreover, we have few frontline stocks viz; Tech

Mahindra, Sesa Sterlite and Dr Reddy results to be announced today. Markets are likely to

remain volatile ahead of expiry.

Stocks to watch for: SBIN, IRB and Cipla on the upside while CESC, RCom and Colgate

Palmolive on the downside