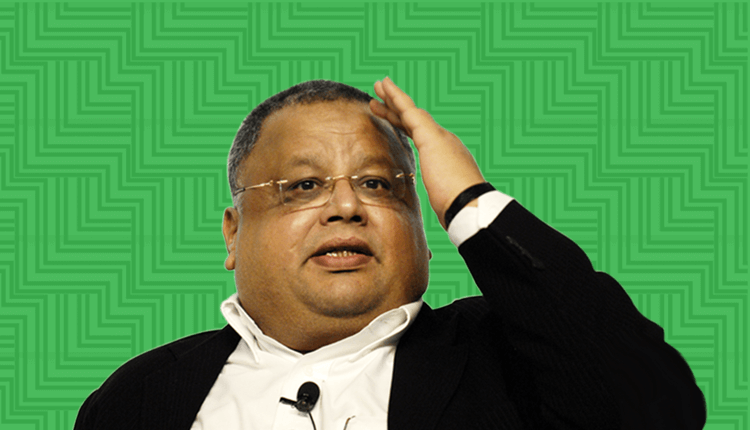

Is Rakesh Jhunjhunwala Too Big To Be A Role Model?

Feb 02, 2017 | 18:29 PM IST

Feb 02, 2017 | 18:29 PM IST

You must have noticed that Warren Buffett quotes and Rakesh Jhunjhunwala's tips as well as quotes are blatantly cited in the context of investment. Some quotes are composed with such authority that they instantly lure you into believing anything that follows. But sometimes these quotes and anecdotes can be quite misleading. Naturally, the question you will ask is isn't Jhunjhunwala's philosophy worth following? On the broader level, one can even ask, is Rakesh Jhunjhunwala an ideal role model for the retail investors? Yes, he is! But what works for him may not necessarily work for you.

It's high time to put in perspective this entire concept of blindly following one's role model.

Celebrity Investors' Quotes Are Not Ready-made Investment Plans

The quotes of famous people are used to give credibility to the point one is trying to make. In no circumstances could it be absolute. Likewise, looking at Rakesh Jhunjhunwala's tips and quotes in isolation can oversimplify the complex matter like investment. Investment plans have to be tailor-made to suit the requirements of an individual. Furthermore, if stock market happens to be your medium of investment you have to be all the more careful and diligent in your planning.

Brush Away The Halo Effect

In order to achieve your financial goals, it's important to first define your financial goals in terms of priorities. It's true that going long in stock investment is a good idea for the retail investors, but to meet your financial goals you can bend this golden rule a little. One can mend one's way to suit one's needs. For example, you have bought 250 shares in Tata Motors when it was trading at 450. When it reaches 500, you are in Rs. 12,500 profit. Now you can either book the profit or stay invested and go long with this stock. This is the point where your judgement comes into play.

Don't Follow Rules Blindly, Personalise Them

Famous quotes, maxims, sayings sound good but they are just thoughts, they can't be a sustainable investment plan. There are many famous quotes attributed to Rakesh Jhunjhunwala and Warren Buffett and they do talk about the wisdom of investment in an evolved manner. However, retail investors should learn to give the famous investment rules a spin of personalisation. There is no doubt that these investment rules are the outcome of years of experience and practice of these investors but everyone has to have his own investment strategy which works best for him. Hence it always pays to follow these rules but don't let them become shackles on your rational thinking.

Be Smart And Selective

There are many ways one can misinterpret investment rules. It would be fair to say that many times these quotes are used out of context. For example, both Rakesh Jhunjhunwala and Warren Buffett profess the advantages of long-term investment, indeed, it's a good policy, but if you apply it on stocks which have short-term potential you are bound to face heavy losses. Yes, every stock has to be assessed to determine whether it has short-term or long-term growth potential. Thus it's important to be selective in your approach. To make smart investment choices you can either do an in-depth research or subscribe to a good stock advisory firm which follows Warren Buffet and Rakesh Jhunjhunwala's tips and identifies good stocks to help you stay ahead in your investment.