3 Trump Cards Of Celebrity Investors

Feb 08, 2017 | 14:14 PM IST

Feb 08, 2017 | 14:14 PM IST

Browsing through the success stories of the famous investors you must have often thought that what are they doing that we aren't? Is it that these elite club members have cracked a success code through which they have succeeded over the years? To put all your queries to rest, let's try to find the similarities in the investment pattern of the celebrity investors like Rakesh Jhunjhunwala for tips.

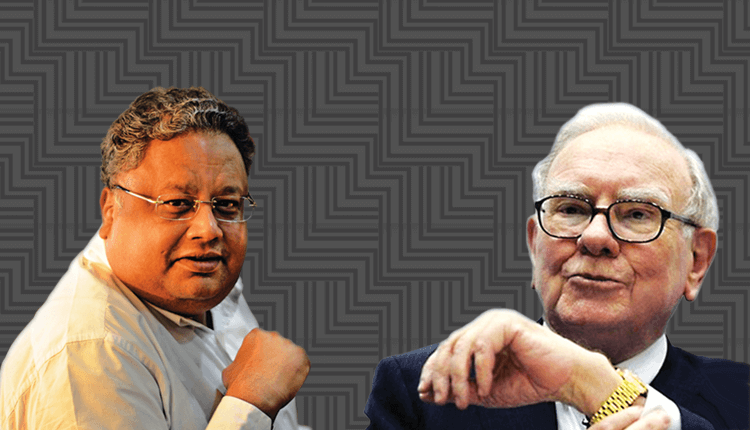

Though there are many famous investors in India and abroad but Rakesh Jhunjhunwala and Warren Buffett are the only celebrity investors people literally swear by; in fact 'Rakesh Jhunjhunwala Tips' is one of the most searched terms by investors on Google. So let's analyse these famous investors' body of work and try to understand the similarities in their investment pattern. The entire exercise is to identify the broad points in their investment behaviour so the retail investors like you and me can emulate the same for our benefit.

Believe In Value Investing

One of the qualities that bind both Jhunjhunwala and Buffett together is they are the staunch believer of value investing. In this regard, both these master investors have almost identical behaviour. Value investing not only nullifies the market risk to a great extent but it is also one of the best methods to identify undervalued stocks. Just one glance at Rakesh Jhunjhunwala's portfolio will give you a fair idea of how he goes about choosing stocks. He picks his companies with clockwork precision. More often than not he tries to stay away from the popular over-priced stocks.

Value investment simply means to invest in sustainable businesses which have undervalued stocks. Usually, value investors like Rakesh Jhunjhunwala and Warren Buffett look to make a profit from stocks which have lower profit P/E (price earning) ratios compared to the peer group, lower than average price-to-book ratios and higher dividend dispensation. All these statistics are used to analyse the growth potential of the stocks. Only after getting satisfactory results on all the above-mentioned counts value investors proceed with their investment.

Invest In Businesses That You Understand

Rakesh Jhunjhunwala tips that behind the stock there is an empire of businesses and industries which propel the stocks to perform. A flourishing business is as important to stock as wheels are important to a vehicle.

However, despite its enormous importance, investors often disregard the details of business before investing. Value investors like Buffett and Jhunjhunwala would never skip this critical step. Warren Buffett goes a step further, he has made it a point to invest only in the businesses which he understands. Hence he only invests in oil, banks, food, insurance, razors, soda and generally stays clear of stock like Information Technology (IT) as he doesn't understand their businesses and products.

On the other hand, Rakesh Jhunjhunwala aka India's Warren Buffett devotes ample amount of time in examining minute details of the companies he is going to invest in. From Sesa Goa to Titan and Lupin Jhunjhunwala's holdings are bulging with companies which nobody had heard of before he bought stakes in it. It only illustrates his conviction in the businesses and on his own research.

Patience Is A Virtue

For a sapling of investment to grow one needs to give it sunlight of patience and water of time only then this tiny sapling will grow into a sprawling tree. Yes, your investment needs a lot of time to grow, sometimes years and decades to give good results. On this count too both Rakesh Jhunjhunwala and Warren Buffett have the uncanny similarity. Both have the exemplary patience to wait and let the stocks run the full course. It's easier said than done, as the moment stock starts its upward curve ordinary investors book profit in haste and miss out bigger chunk of profit.

It's the temperament which separates celebrity investors from normal investors. They are playing on the same field like others, only their finesse and level-headed manoeuvring elevates their game to a different level.