Rakesh Jhunjhunwala’s Latest Portfolio, Top Holdings, News Jan 2020

Jan 16, 2020 | 17:57 PM IST

Jan 16, 2020 | 17:57 PM IST

Rakesh Jhunjhunwala is Indias billionaire investor even known as Indian warren buffet. Rakesh Jhujhunwala is one of the most respected guru investors in India. And investor from all the classes tries to follow him to learn the technique of investment. Rakesh Jhunjhunwala manages his investments as a partner in Rare Enterprises. He ranks as the 54th richest person in India (As on Jun-18).

Many of the beginner, as well as pro investors, follow Rakesh Jhunjhunwala as their investment guru. People follow his recommendations blindly and are even keen to know the recent activities in his portfolio. So here Niveza brings you the real-time updated portfolio of Mr.Rakesh Jhunjhunwala.

Contents

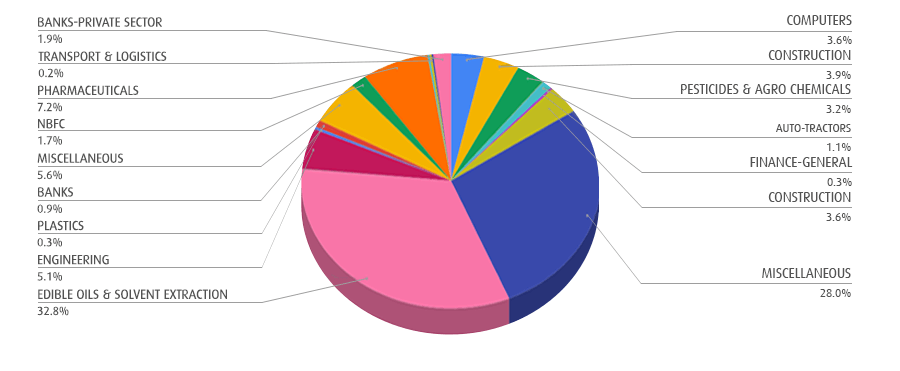

Rakesh Jhunjhunwala's Latest Portfolio And Holdings

| Company | Sector | Quantity Held on 30-Sep-19 | Percent Holding on Sep-19 | Price on 30th Sep 2019 | Last Price on 15-Jan-2020 | Holding Value on 15-Jan-2020 | Gain/Loss (%) Since 30th Sep 2019 |

|---|---|---|---|---|---|---|---|

| Aptech Ltd. | COMPUTERS | 9668840 | 24.24% | 156.55 | 173.5 | 1677543740 | 10.83% |

| The Mandhana Retail Ventures Ltd. | RETAIL | 2813274 | 12.74% | 12.5 | 11.75 | 33055969.5 | -6% |

| NCC Ltd. | CONSTRUCTION | 62333266 | 10.38% | 55.1 | 60.05 | 3743112623.3 | 8.98% |

| Rallis India Ltd. | PESTICIDES & AGRO CHEMICALS | 18980820 | 9.76% | 176.65 | 196.45 | 3728782089 | 11.21% |

| Bilcare Ltd. | PACKAGING | 1997925 | 8.48% | 24.02 | 20.8 | 41556840 | -13.41% |

| Agro Tech Foods Ltd. | AUTO - TRACTORS | 2003259 | 8.22% | 581 | 678.2 | 1358610253.8 | 16.73% |

| Escorts Ltd. | FINANCE - GENERAL | 10000000 | 8.16% | 27.3 | 29.4 | 294000000 | 7.69% |

| Geojit Financial Services Ltd. | CONSTRUCTION | 18037500 | 7.57% | 169 | 198.85 | 3586756875 | 17.66% |

| Delta Corp Ltd. | MISCELLANEOUS | 20000000 | 7.38% | 1272.8 | 1184.75 | 23695000000 | -6.92% |

| Titan Company Ltd. | EDIBLE OILS & SOLVENT EXTRACTION | 57751220 | 6.51% | 483.15 | 724 | 41811883280 | 49.85% |

| Autoline Industries Ltd. | AUTO ANCILLARIES | 1751233 | 6.48% | 40.9 | 24.75 | 43343016.75 | -39.49% |

| Crisil Ltd. | MISCELLANEOUS | 3965000 | 5.48% | 1370.75 | 1807.5 | 7166737500 | 31.86% |

| VIP Industries Ltd. | ENGINEERING | 7500400 | 5.31% | 691.25 | 937.05 | 7028249820 | 35.56% |

| Ion Exchange (India) Ltd. | PLASTICS | 775000 | 5.29% | 479.75 | 454.45 | 352198750 | -5.27% |

| Multi Commodity Exchange of India Ltd. | BANKS | 2000000 | 3.92% | 960.25 | 1376.9 | 2753800000 | 43.39% |

| Jubilant Life Sciences Ltd. | MISCELLANEOUS | 5500000 | 3.45% | 504.1 | 546.55 | 3006025000. | 8.42% |

| Anant Raj Ltd. | BANKS | 10000000 | 3.39% | 90.4 | 91 | 910000000 | 0.66% |

| Federal Bank Ltd. | COMPUTERS | 60721060 | 3.11% | 46.95 | 43.05 | 2614041633 | -8.31% |

| Firstsource Solutions Ltd. | CONSTRUCTION | 21470000 | 3.1% | 33.55 | 39.25 | 842697500 | 16.99% |

| TV18 Broadcast Ltd. | NBFC | 44560000 | 2.6% | 38.7 | 16.8 | 748608000 | -56.59% |

| Dewan Housing Finance Corporation Ltd. | CONSTRUCTION | 7720000 | 2.46% | 7.82 | 10.9 | 84148000 | 39.39% |

| D B Realty Ltd. | CONSTRUCTION | 5000000 | 2.06% | 16.4 | 20.85 | 104250000 | 27.13% |

| Prozone Intu Properties Ltd. | PHARMACEUTICALS | 3150000 | 2.06% | 715.35 | 751.15 | 2366122500 | 5% |

| Spicejet Ltd. | MEDIA & ENTERTAINMENT | 10000000 | 1.67% | 23.9 | 27.05 | 270500000 | 13.18% |

| Fortis Healthcare Ltd. | PHARMACEUTICALS | 12500000 | 1.66% | 135.05 | 143.1 | 1788750000 | 5.96% |

| Lupin Ltd. | PHARMACEUTICALS | 7070605 | 1.56% | 504.1 | 546.55 | 3864439162.75 | 8.42% |

| Prakash Pipes Ltd. | DIVERSIFIED | 312500 | 1.53% | 47.5 | 62.1 | 19406250 | 30.74% |

| Prakash Industries Ltd. | TRANSPORT & LOGISTICS | 2500000 | 1.46% | 125.15 | 104.4 | 261000000 | -16.58% |

| Orient Cement Ltd. | CEMENT | 2500000 | 1.22% | 89.75 | 85.85 | 214625000 | -4.35% |

| Man Infraconstruction Ltd. | CONSTRUCTION | 3000000 | 1.21% | 20.2 | 31.25 | 93750000 | 54.7% |

| Edelweiss Financial Services Ltd. | NBFC | 10000000 | 1.07% | 94.9 | 108.95 | 1089500000 | 14.81% |

| Karur Vysya Bank Ltd. | BANKS - PRIVATE SECTOR | 33583516 | 4.21% | 59.85 | 57.2 | 1920977115.2 | -4.43% |

About Rakesh Jhunjhunwala

Rakesh Jhunjhunwala grew up in Mumbai and born on 5th July 1960. His father was a designated income tax officer and had a great interest in the stock markets. His father's keen interest in the markets, in turn, excited Rakesh Jhunjhunwala at an early age. After graduating from Sydenham College he got enrolled to Institute of Chartered Accountant of India (ICAI) to carry his passion for share market trading and investing.

Rakesh Jhunjhunwala designates at various organizations in India with his investment stakes. He is chairman of Aptech Limited as well as Hungama Digital Media Entertainment Pvt Ltd. Prime Focus Limited, Bharat SiS companies like Gopal BNP Paribas Financial Services Ltd, Bilcare Limited, Praj Industries Limited, Provogue India Ltd., Concord Biotech Limited, Innovasynth Technologies (I) Limited, Mid Day Multimedia Ltd. are some other ventures where Rakesh Jhunjhunwala have invested.

How Rakesh Jhunjhunwala Finds Multibaggers?

The first multibagger that Rakesh Jhunjhunwala unlocked was Tata tea. He bought 5000 shares of tata tea at Rs.43 and made a profit of Rs.100 per share by selling it at the price of Rs.143. Post this Tata power then Sesa Goa and many more Rakesh Jhunjhunwala carried the chain of unlocking multibaggers.

Many investors are curious about how he finds multibagger stocks, the answer lies in his investment strategy. He is a strong believer in the long term investment and he thinks Buying right and holding tight always works. A correct stock with sound financial and good business will do well, in the long run, the simplest formula that Rakesh Jhunjhunwala follows to bag multibagger returns. Lupin, Crisil, and Titan are some of his stocks which show this approach clearly.

Read: Best Multibaggers Stocks For 2019 to uncover multibaggers of this year.

Rakesh Jhunjhunwala Latest News

- The Best Stock Of RJ Minimized His Wealth

- Welcome the New Stock In Rakesh Jhunjhunwalas Multibagger List

- Stock Which Reaped 38% Return For Rakesh Jhunjhunwala Since Last Holi

- Rakesh Jhunjhunwala Made 7-8% With These Two Stocks? Do You Own One

- Rakesh Jhunjhunwala Looking For IRDA nod For Star Health Insurance Investment

- How Titan enriched Rakesh Jhunjhunwala