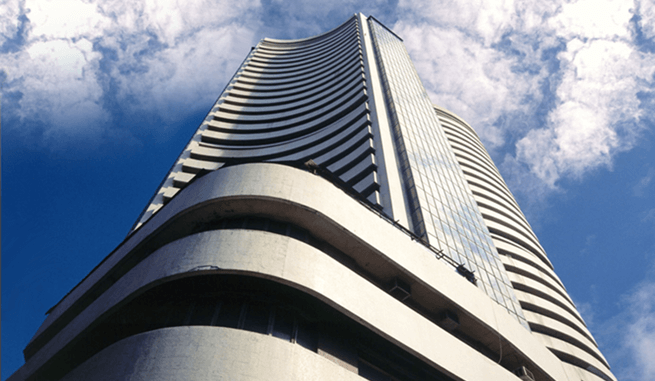

Sensex Rallies 176 Points; Nifty Above 10,500

Jan 04, 2018 | 18:48 PM IST

Jan 04, 2018 | 18:48 PM IST

Share Market News 04-January-2018

The market started on a positive note on Thursday as Sensex gained over 50 points while Nifty opened above 10,450 mark. Broader market also started on a positive note as Nifty midcap was up by .20%. The market continued to trade steadily after a moderately higher opening as Sensex was up by 53 points and Nifty was up by 16 points to held 10,450 mark.

In the afternoon session, benchmark indices traded higher with the Sensex raised over 130 points while Nifty continued to trade above 10,450 mark backed by rally in PSU banks. In last hour of trade, the market continued to trade higher as Sensex was up by 160 points and Nifty traded around 10,500 mark. Nifty midcap and smallcap continued to outperform. The market ended on a strong, positive note. Nifty midcap was up by almost 1%. Sensex closed 176.26 points up at 33,969.64, Nifty closed 61.60 points up at 10,504.80.

Top Gainers

Tata Steel by 3.88% to Rs.763.45, Dr. Reddy by 3.24% to Rs.2,414.80, L&T by 2.98% to Rs.1,313.30, Asian Paint by 2.92% to Rs.1,175.30, ONGC by 2.74% to Rs.198.75.

Top Losers

Tata Motors by 0.90% to Rs.430, Eicher Motors by -0.70% to Rs.28,614, BPCL by -0.69% to Rs.491.50, Infosys by -0.62% Rs.1,015, Power Grid by -0.62% to Rs.200.40.

Analysis Of Top Gainer And Loser

Tata Steel is the top gainer in today's market as companys CEO & M.D. is very positive regarding 2018 as there is stability in global steel market and also in domestic market. Phase 1 of Kalinganagar plant is expected to drive near-term volume growth.

Tata Motors is the top loser in today's market as companys Jaguar Land Rover, the UK's largest luxury carmaker, sold 11,394 units in last month of 2017, which was lower by 9.4 percent compared with 12,573 units sold a year ago.

Key Market News

The government on Thursday asked parliament approval for Rs.80,000 crore ($12.62 billion) extra spending to recapitalise state banks as part of a move to help lenders deal with bad debts and revive credit growth.

US factory activity increased more than expected in December, boosted by a surge in new orders, it is a further sign of strong economic momentum at the end of 2017. The economys robust fundamentals were also underscored by other data on Wednesday showing construction spending rising to a record high in November amid broad gains in both private and public outlays.

Indias services sector growth improves in December as seasonally adjusted Business Activity Index improved to 50.9 in December from 48.5 in November, signalling a renewed increase in business activity.

Stocks To Watch

Jindal Steel & Power is on the upside while Graphite India is on the downside.

Jindal Steel & Power is currently trading at Rs.242.75, up by Rs.23.20 or 10.57% from its previous closing of Rs.219.55 on the NSE. The scrip opened at Rs.220.95 and has touched a high and low of Rs.252 and Rs.217.10 respectively. So far 4,45,49,944(NSE) shares were traded on the counter. The current market cap of the company is Rs.22,335.74 Crore. The NSE/BSE group stock has touched a 52 week high of Rs.252 on 04-January-2018 and a 52 week low of Rs.69.85 on 03-January-2017.

Graphite India is currently trading at Rs.824.70, down by Rs.42.15 or 4.86% from its previous closing of Rs.866.85 on the NSE. The scrip opened at Rs.879 and has touched a high and low of Rs.906 and Rs.823.55 respectively. So far 73,95,253(NSE) shares were traded on the counter. The current market cap of the company is Rs.16,118.49 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.906 on 04-January-2018 and a 52 week low of Rs.72.90 on 03-January-2017.