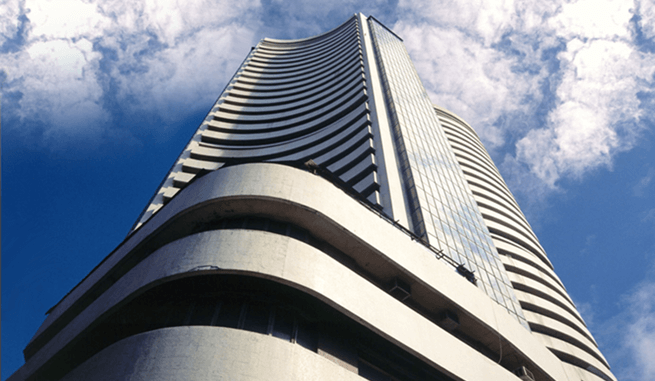

Profit Booking Continues; Nifty Below 9850

Aug 10, 2017 | 18:16 PM IST

Aug 10, 2017 | 18:16 PM IST

Share Market News 10 August 2017

There was huge selling seen in today's market as yesterday's profit booking continued in each sector especially in midcap and smallcap companies. SAT (The Securities Appellate Tribunal) has issued a stay order on SEBI order for J Kumar Infraprojects as well as Prakash Industries and directed the exchange to start trading in these two companies. Sensex lost 266.51 points to 31531.33, Nifty lost 87.80 points to 9820.25.

Top Gainers

Tech Mahindra by 2.89% to 405.25, Aurobindo Pharma by 1.81% to 696, INFY by 1.61% to 984.95, L&T by 1.05% to 1166 and Wipro by 0.92% to 289.15.

Top Losers

Tata Motors by 8.15% to 382.15, Tata Motors(DVR) by 7.95% to 223, Dr.Reddy by 5.04% to 1945.10, Bank of Baroda by 3.99% to 149 and GAIL by 3.68% to 368.15.

Analysis of Top Gainer and Loser

Tech Mahindra is the top gainer in today's market as the stock has been consolidating at a strong support level due to that huge buying was seen in this stock.

Tata Motors is the top loser in today's market as the rating agencies and analyst have reduced the price target over weaker earnings in both Jaguar Land Rover (JLR) and Indian operations in the 1st quarter of FY17-18.

Key Market News

To minimise Current account deficit (CAD) and to reduce the green house gases emission Indian government is going to announce a new policy to promote biofuels soon. India is the third largest green house emission country in the world. Oil imports are major part of India's import and to reduce that import biofuel it is necessary and it will ultimately save India's foreign exchange and 3 Indian big 3 companies spending 2 billion on research to develop biofuels.

Eicher Motors presented an outstanding numbers today as profit has increased 22% in first quarter to Rs. 460 crore against Rs.376 crore last fiscal. Consolidated total income has increased 30% to Rs. 2,333 crore as compared to Rs.1,801 crore a year ago.

Stocks to Watch

Goldstone Infratech is on the upside while Tata Motors is on the downside.

Goldstone Infratech is currently trading at Rs.102.30, up by Rs.9.30 or 10% from its previous closing of Rs.93 on the NSE. The scrip opened at Rs.93 and has touched a high and low of Rs.102.30 and Rs.93. respectively. So far 369238(NSE) shares were traded on the counter. The current market cap of the company is Rs.368 Crore. The BSE/NSE group stock has touched a 52 week high of Rs. 107.60 on 21-April-2017 and a 52 week low of Rs.19 on 29-September-2016.

Tata Motors is currently trading at Rs.380.20, down by Rs.35.85 or 8.62% from its previous closing of Rs.416.05 on the NSE. The scrip opened at Rs 401 and has touched a high and low of Rs.403.60 and Rs.375.25 respectively. So far 28114017(NSE) shares were traded on the counter. The current market cap of the company is Rs.129347 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.598.40 On 07-September-2016 and a 52 week low of Rs. 375.25 on 10-August-2017.