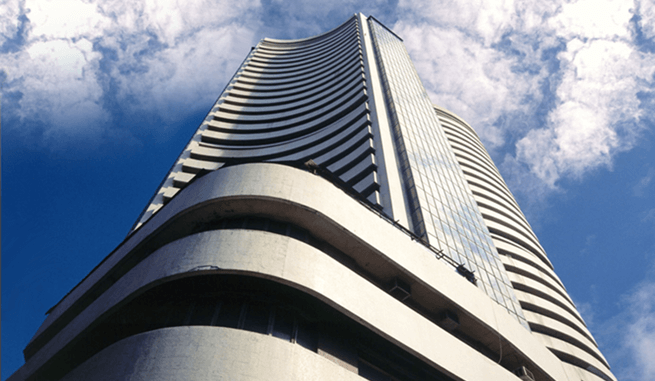

Market Bounced Back; Nifty Above 10,500 Ahead Of Inflation Data

Feb 12, 2018 | 18:50 PM IST

Feb 12, 2018 | 18:50 PM IST

Share Market News 12-February-2018

The Benchmark indices as well as broader markets opened the week sharply higher on Monday as sensex climbed 220 points while Nifty opened above 10,500 levels. Market continued to trade higher with sensex raised over 200 points while Nifty continued to hold 10,500 mark. All Indices traded in green while Nifty midcap and smallcap was up by 1.30% and 1.60% respectively.

In the afternoon session, benchmark indices traded sharply higher with Sensex raised 220 points and Nifty rose 61 points to trade above 10,500. The market extended gains in late afternoon session as Sensex gained over 300 points. The Nifty reclaimed 10,550 levels while the Nifty midcap index was up by 1.5%. Among sectors, Banks, Auto, Metals and Pharma indices gain 1-2 percent.

In last hour of trade, market extended rally as Sensex rose over 320 points while Nifty gained over 95 points above 10,550. Market recouped some of the previous days losses and closed higher. Broader market outperformed as Nifty midcap and smallcap were up by 1.40% and 1.79%. Sensex closed 294.71 points up at 34,300.47, Nifty up by 84.40 points at 10,539.75.

Top Gainers

Tata Steel by 4.14% to Rs.713.70, AuroPharma by 2.97% to Rs.607, UPL by 2.85% to Rs.728.55, Yes Bank by 2.81% to Rs.334.70, IndusInd Bank by 2.80% to Rs.1,696.10.

Top Losers

HCL Tech by -2.49% to Rs.940, SBIN by -2.13% to Rs.290.10, BPCL by -1.87 to Rs.466.50, Bharti Infratel by -1.27% to Rs.337.15, Tech Mahindra by -1.14% to Rs.588.45.

Analysis Of Top Gainer And Loser

Tata Steel is the top gainer in today's market as the company reported a five-fold jump in its third quarter profit. It had posted a consolidated net profit to Rs.1,135.92 crore for the third quarter ended December 31 compared to Rs.231.90 crore in the same quarter of last fiscal. The consolidated income for Q3 FY17-18 increased to Rs.33,672.48 crore, from Rs.29,154.75 crore in the year-ago period.

HCL Tech is the top loser in today's market as selling pressure was seen in stock.

Key Market News

US President Donald Trump signed Spending Bill. The bill increases US government funding by March 23 to keep agencies open while separately building military and domestic spending by almost $300 billion over two years financed through borrowed money, therefore ending a short federal government shutdown after Congress let a midnight deadline slip.

The Indian governments direct tax kitty swelled to Rs.6.95 lakh crore during the April-January period of the current fiscal, a growth of 19.3% over the year-ago period. The governments direct tax kitty swelled to Rs.6.95 lakh crore during the April-January period of the current fiscal, a growth of 19.3% over the year-ago period. The net collections for Corporate Income Tax (CIT) showed a growth of 19.2% and for Personal Income Tax (PIT) at 18.6%. Refunds amounting to Rs.1.26 lakh crore have been issued during 10-month period of the current fiscal.

Stocks To Watch

Bank Of Baroda is on the upside while Fortis Healthcare Ltd. on the downside.

Bank of Baroda is currently trading at Rs.168.90, up by Rs.12.65 or 8.10% from its previous closing of Rs.156.25 on the NSE. The scrip opened at Rs.159 and has touched a high and low of Rs.172.90 and Rs.159 respectively. So far 4,89,26,198 (NSE) shares were traded on the counter. The current market cap of the company is Rs.38,859.65 Crore. The NSE/BSE group stock has touched a 52 week high of Rs.206.65 on 26-October-2017 and a 52 week low of Rs.133.50 on 23-October-2017.

Fortis Healthcare is currently trading at Rs.139.50, down by Rs.9.10 or 6.12% from its previous closing of Rs.148.60 on the NSE. The scrip opened at Rs.148.55 and has touched a high and low of Rs.152.70 and Rs.137.80 respectively. So far 2,63,30,832 (NSE) shares were traded on the counter. The current market cap of the company is Rs.7,224.76 Crore. The BSE/NSE group stock has touched a 52 week high of Rs.228.95 on 03-May-2017 and a 52 week low of Rs.107.10 on 06-February-2018.